How much can a single person borrow for a mortgage

So if your lender is. Save Real Money Today.

How To Pay Your Mortgage With A Credit Card Forbes Advisor

Its A Match Made In Heaven.

. Some of the Government schemes you may be able to use with a single person mortgage include. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. For example if you.

Ad Compare More Than Just Rates. 10 Best Mortgage Lenders In 2022 - Get Rates Apply Easily - Compare Current Rates. When arranging mortgages we need to.

Its possible to get a one-person mortgage with a 5 deposit. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Ad Top Mortgage With The Lowest Rates - Easy Mortgage Solution - Apply Get Approved Today.

First time buyers can take out a mortgage of up to 90 of the purchase price of a home. The first step in buying a house is determining your budget. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Looking For A Mortgage. How much house you can afford is also dependent on. How much can you borrow as a single person.

Factors that impact affordability. If your deposit is 20 of the houses value then the loan could be up to 80 provided you can afford the regular mortgage repayments. Its A Match Made In Heaven.

Your expenses - lenders will look through your bank statements. But ultimately its down to the individual lender to decide. Ad Compare Mortgage Options Get Quotes.

A single-person application can sometimes be stronger than a joint application. Get Started Now With Quicken Loans. If you earn 30000 a year the maximum you may be able to borrow based on 45 times your income would be.

That means your mortgage could. Fill in the entry fields. Were Americas 1 Online Lender.

For example Halifax will lend 5 times the income of a. Often lower percentages are loaned on properties outside urban areas and. Get Started Now With Quicken Loans.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure.

This simply isnt true. Ad Prequalify Online For A Chase Fixed Rate Or Adjustable Rate Mortgage. As part of an.

Set some time aside to sit down and go through your finances. Find A Lender That Offers Great Service. Your income - generally banks want to see you spend no more than 30 of your income on a home loan.

Many lenders place the limit. Looking For A Mortgage. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements.

Mortgage lenders will decide the. The optimal amount for the best possible mortgage deal is 40 per cent. The maximum amount you can borrow with an FHA-insured.

Calculate what you can afford and more. Consider how much you can comfortably afford to pay each month without forgetting your other necessary expenses. Generally we can expect a lender to lend up to 80 of the value or price of a house generally whichever is lower.

When it comes to calculating affordability your income debts and down payment are primary factors. Set some time aside to sit down and go through your finances. There are no limits for single people who want to get a mortgage other than the financial limits created by applying with only one income.

Ad Compare Mortgage Options Get Quotes. This mortgage calculator will show how much you can afford. Lifetime ISA gives you a government bonus of 1000 if you save a.

The sweet spot for getting a better mortgage deal is a 25 per cent deposit. Were Americas 1 Online Lender. There are lenders that offer a slightly lower income multiple for joint applicants compared to individual applicants.

Its possible to get a one-person mortgage with a 5 deposit. How much can you borrow as a single person. Second time buyers can take out a mortgage of up to 80.

Your income will determine the maximum amount you can borrow in a single-person mortgage. For you this is x. Your income will determine the maximum.

5 Types Of Private Mortgage Insurance Pmi

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

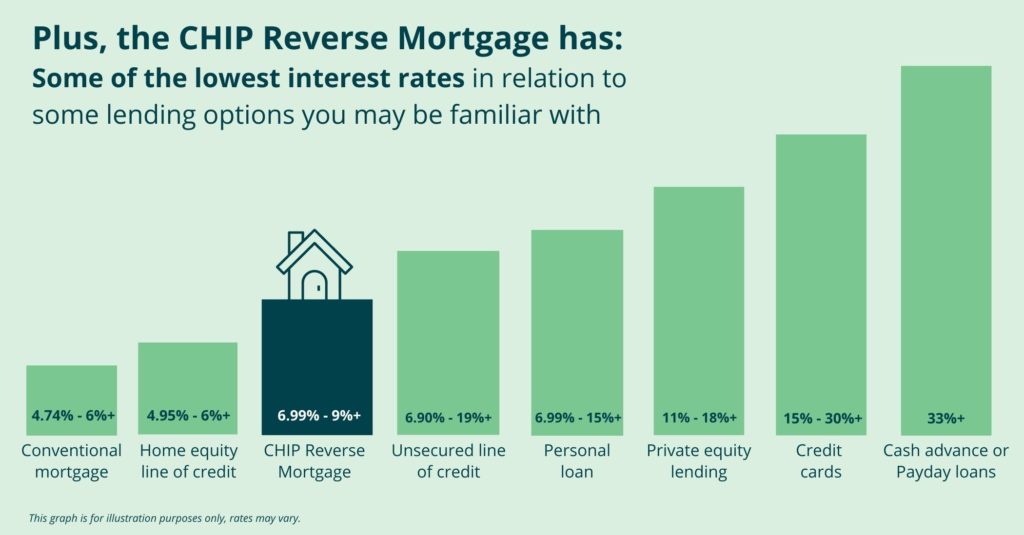

Chip Reverse Mortgage Rates Homeequity Bank

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

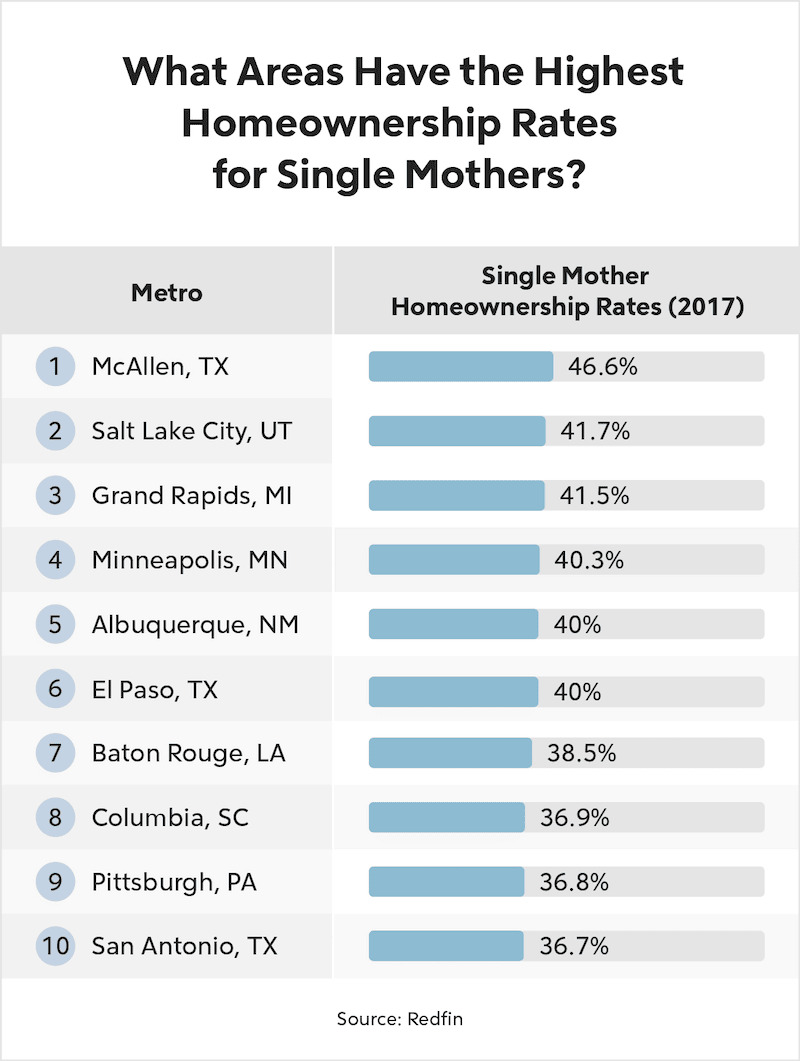

Home Loans For Single Mothers Quicken Loans

Pros And Cons Of Joint Mortgages Loans Canada

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Oh Dear You Can 39 T Pay Your Bills Andyou Need To Borrow Money Funny Quotes Money Quotes Quotes

4 Ways Life Insurance Can Protect Your Family S Future Life Insurance Life Single Income

5 Reasons Why Most People Don T Become Wealthy Success Business Wealthy Infographic Wealth Entrepreneur Entrepreneur Tips How To Become Rich Wealthy Financial

How Many Names Can Be On A Mortgage Bankrate

What S The Lowest Mortgage Amount You Can Get Experian

5 Types Of Private Mortgage Insurance Pmi

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

![]()

Pros And Cons Of Joint Mortgages Loans Canada

Reverse Mortgage Calculator

2